Opportunity Zones were established as part of the 2017 Tax Cuts and Jobs Acts, ostensibly as an economic development tool. They are designated low-income census tracts where individuals or corporations may receive federal capital-gains tax breaks for investing through vehicles called Quality Opportunity Funds. Thanks to a unique disclosure provision of a state incentive in Ohio, the study by Anya Gizis and Wiktoria Rutkowska analyzes the program in the Buckeye State. The reports findings include:

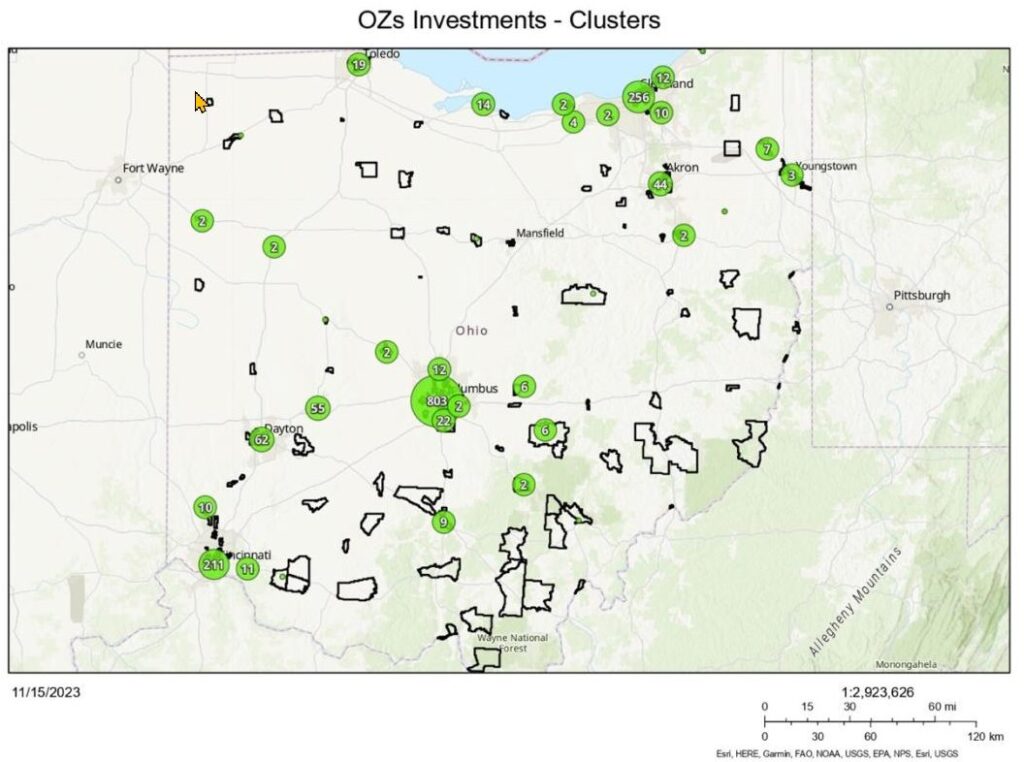

- The investments are concentrated in a small number of urban areas, mainly Cleveland, Columbus, and Cincinnati. Indeed, just five cities received 88% of the dollars invested.

- OZs in rural and Appalachian Ohio received almost no investments.

- OZs that have received investments tend to have gentrifying characteristics — becoming whiter and richer.

- Almost 16% of the money invested has been within one mile of a college. College towns often qualified as an OZ because big student populations drove down the average wage.

The above illustration shows the heavy concentration of investment locations in urban areas. The black-outlined areas represent census tracts that are designated OZs. Although southeast Ohio has many census tracts designated as OZs, there have been almost no investments made there thus far. This region, Appalachian Ohio, has been historically disinvested and experiences high amounts of poverty,4 a trend that OZs have done nothing to reverse.

Although there is currently federal legislation looking to extend and expand the program, the authors recommend that the program be allowed to sunset in 2026. Additional transparency and reporting requirements, included in proposed legislation to extend and expand the program, would not change the underlying problems with the program, which include its limited participation pool (only those with capital gains can access it); lack of community input in the types of projects the tax breaks support, and that it appears to have failed to drive investment in the poorest communities, in Ohio and beyond.